In our previous article about tax tips for motorsports businesses, a basic sole proprietorship was described. It is a simple business form from a taxation standpoint. Once business activities, income, and expenses become significant, a sole proprietorship may not be the best. More indemnification and accounting flexibility may be needed. An accounting example would be a business fiscal year for tax obligation reporting that is more in-line with your annual business fluctuations. It may be different than your calendar year required for person income tax.

Corporation

Forming a corporation is the next step. This can provide less business liability to the owner and with different accounting that sets up the business as a separate entity.

Various forms of corporations exist. Information about various forms of corporations are in many books and info on the web. Also, an attorney or accountant can be consulted to find the right corporation for your needs.

The following information is based on our experiences several years ago forming and running a C-corp.

C-Corp

In a C-corp, ownership of a business is established by issuing shares of stocks to a person or group of people. Investors who want to remain non-employees such as family members can be issued stock. Legal and accounting rules are used to establish the value of the stock. Stock can be sold to other owners or investors. Company ownership can be proportioned in different ratios to more than one owner using different numbers of shares of stock. If necessary, the entire company can be sold through the sale of stock. Also, shares of stock can be willed to heirs that may avoid the cost of probate.

C-corps can be set up with a fiscal year different than the calendar year.

Fiscal year sales dollars, expenses, and retirement contributions can be moved forward or backward, from one calendar year to another. That can provide added income to the owner.

Bookkeeping and accounting are more extensive for a C-corp:

- gross sales – cost of sales – expenses = profit; profit is taxed at a corporate rate

- assets accounting

- liabilities accounting.

All three of these factors are used to make up a balanced corporate tax return.

A balanced corporate tax return, by its very nature, provides more accounting for the business operation and, as such, may be at a lower tax audit risk.

Owners who work in their C-corp are paid as W2 employees just like the other staff. W2 wages are subject to federal tax, state tax, local tax, disability, social security, and Medicare withholdings.

Retirement contributions can usually be made through the corporation that may be in greater amounts than for sole proprietor filers. Medical expenses may be fully deductible. Other business expenses are fully deductible such as travel to motorsports events and facility lease & maintenance costs.

C-Corp Advantages

Our corporate attorney told us that one of the biggest advantages of forming a corporation is that liability from business transactions is usually limited to corporate assets. These can include the equipment and corporate stock. He said that the owner is responsible for limited indemnification. In the event of liability involving the business, the business is responsible for the liability cost to the limit of the assets. The owner’s personal assets such as savings, investments, home, or auto usually are not included.

Our accountant said that cars and trucks can be leased to the corporation. Insurance for the business use of cars and trucks can also be charged to the corporation. At the time of our corporation existance, there was no insurance distinction between regular cars and sports cars that were owned by our corporation.

This can make insurance costs lower for younger employees that may want to drive a hotrod.

Our bank representative said that business line of credit limits may be greater than personal loan limits. Especially when a business becomes more expensive, larger line of credit limits become more important to weather the dips between sales and expenses.

At the time of our C-corp, we could take a research credit for our technical research expenses. We averaged $2,000 per year for research expenses which gave us approximately $500 of corporate tax credit after research credit tax computations.

Research was defined as expenses for the development of technology in our field. For engine builders, it could be testing or dynamometer expenses for a new combination with more power, better mileage, or new EFI technology for example. For a racing team, it could be the cost of a test outing for researching more performance.

More Benefits to C-Corp

Even though accounting is more extensive, it was a window into the health of the business. As a result, it was easier to secure a larger line of credit, business liability insurance, and Workers Compensation insurance.

Operating as a corporation also made it easier to get on bid lists for large accounts.

For engine builders, this could include city, county, or state government vehicle contracts. It could also lead to fleet accounts or international engine building markets. It may also make sponsors more interested if you have an identifiable motorsports appearance.

Establishing a C-Corp

At the time that we formed our corporation, it cost approximately $1,000 in corporate attorney fees to write up “articles of incorporation”. These were filed with the state to establish a corporate identity according the laws of our state. The articles of incorporation described our corporate entity and much about the legal description of the business.

There was a minimum corporate tax payment to the state that was a few hundred dollars every year. Accounting fees were around $600/year for preparing our corporate tax return. There were many business lessons to be learned in preparing a balanced tax return that taught us discipline in business structure.

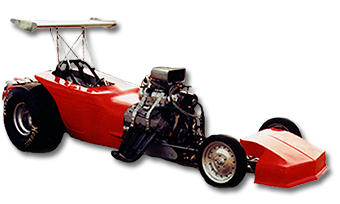

Pride of ownership of a C-corp was enjoyed at the SEMA show, car shows, and motor sports events.